Unsurprisingly, we saw many Americans heading to Europe over the summer to reacquaint themselves with the historic continent after a two-year travel hiatus associated with the pandemic.

There, the soaring dollar has made the pound and the euro feel like Monopoly money to be spent without a care in the world.

Continental Europe is especially popular with savvy shoppers because the European Union allows sales tax – usually set at 20 percent – to be recouped immediately.

The U.K. used to do the same, but as part of the U.K.’s Brexit deal, that benefit was removed from overseas shoppers.

Luxury goods manufacturers have been trying to balance prices across regions by raising prices in the countries with the weakest currencies; this has proven to be the case in all countries except the United States.

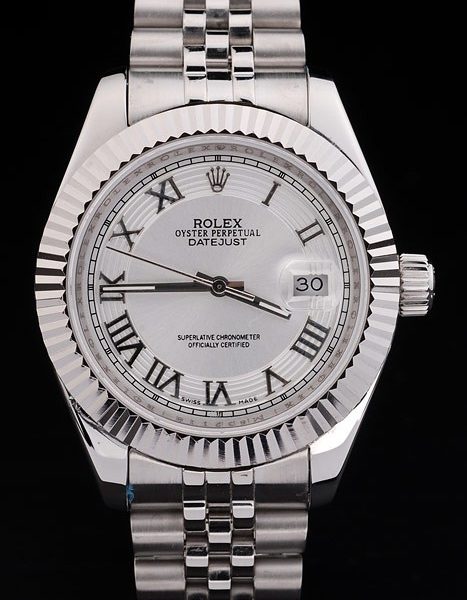

With the pound’s decline, prices in the U.K. were raised in both the first and third quarters. Until November 1, prices in Europe using the euro had been raised only once. That changed last week, when Rolex and others raised prices in the eurozone by about 5 percent.

In an e-mailed statement sent to Bloomberg, Rolex confirmed.” Due to currency fluctuations, prices have been adjusted in the eurozone.”

The price increase addresses the price difference between the U.S. and Europe to some extent, but it is far from eliminating it.

In fact, a WATCHPRO analysis found that U.S. shoppers could still save more than 20 percent if they could refund sales tax on items such as Rolex replica watches after purchasing them in Europe.

The average American walking into an authorized dealer in Paris is unlikely to be able to buy a Rolex without an extensive buying history.

However, Americans shopping in the Eurozone can still save significant amounts of money if they can purchase at retail.

For example, a white gold Rolex Day-Date, priced at $39,590 in the U.S. (including 7% sales tax), would cost the equivalent of $30,833 at today’s dollar/euro exchange rate once sales tax is recouped, a savings of $8,757.